Understanding Construction Loan Requirements in Iowa: Eligibility, Process, and Financing Options

Building a custom home in Iowa starts with securing the right financing, and understanding construction loan requirements in Iowa is essential for any homeowner ready to break ground. Rooted in our expertise with Home Remodeling in Des Moines: Busy Builders LLC. we guide you through loan types, eligibility criteria, application steps, cost considerations, local lender choices, common questions, and how our team simplifies every stage. You’ll learn: financing options.

- The key loan types available in Iowa and how each funds your build

- Credit, down payment, debt-to-income, and project-plan benchmarks lenders expect

- A step-by-step application flow, from lender selection to draw management and conversion

- Financial planning tips on interest locks, closing fees, contingency reserves, inspection schedules, and taxes

- How to compare local banks and credit unions for optimal rates and terms

- Answers to top homeowner questions about Iowa construction financing

- Ways The Busy Builders partner with lenders to streamline approvals and document handling

This comprehensive guide equips you to navigate construction loan requirements, secure funding with confidence, and move seamlessly from plans to permanent mortgage.

What Are the Key Types of Construction Loans Available in Iowa?

Construction loans in Iowa fall into five main categories, each designed to address specific funding needs during different project stages. Understanding these loan types lets you choose the solution that aligns best with your financing options, budget, and builder qualifications.

- Construction-Only Loan

- Construction-to-Permanent (One-Time Close) Loan

- Owner-Builder Construction Loan

- Lot Loan

- Government-Backed Construction Loans

Selecting among these options depends on whether you prefer multiple closings, need a land purchase loan, qualify for a rural program, or plan to act as your own general contractor. Exploring financing options helps you match financing features to your project goals and risk profile.

What Is a Construction-Only Loan and How Does It Work?

A construction-only loan provides short-term financing strictly for the building phase, requiring a separate mortgage once construction ends. It funds your project in stages—foundation, framing, and finishes—and often carries interest-only payments during construction.

- Disbursement Method: Draws based on completed milestones

- Loan Term: Typically 12–18 months for build-out

- Repayment: Interest-only during construction, principal conversion later

This loan type suits homeowners with a ready land purchase or standalone lot loan, offering flexibility in choosing permanent financing at completion without committing to a one-time close structure.

How Does a Construction-to-Permanent Loan Simplify Financing?

A construction-to-permanent loan, also known as a one-time close loan, combines construction financing and the permanent mortgage into a single loan with one closing. It streamlines paperwork and closing costs by converting automatically to a long-term mortgage when building is complete.

- Single Closing: Reduces settlement fees and paperwork

- Rate Lock: Often locks permanent interest rate at closing

- Seamless Transition: Eliminates second underwriting phase

With this structure, borrowers avoid separate approvals and can budget more predictably, knowing permanent financing terms before construction begins.

Are Owner-Builder Construction Loans Available in Iowa?

Owner-builder construction loans cater to homeowners who serve as their own general contractors. Lenders evaluate your construction experience, financial resources, and project complexity before approval.

- Qualification: Proven trade or project management background

- Oversight: Lenders often require periodic inspections or builder endorsements

- Benefits: Potential cost savings on builder fees, greater control over subcontractors

While more documentation and risk assessments are involved, owner-builder loans empower experienced homeowners to directly oversee every detail of their new residence.

What Are Lot Loans and Government-Backed Construction Loans in Iowa?

Lot loans finance raw land purchases when you own the lot separately from construction financing. They bridge the gap until you convert or secure a construction loan. Government-backed construction loans—through FHA, VA, and USDA programs—provide specialized options:

- Lot Loan: Typically 70–80% loan-to-value for land only

- FHA Construction Loan: Low down payment (3.5%), insured by HUD

- VA Construction Loan: Zero down payment for eligible veterans

- USDA Construction Loan: 0% down for rural, qualifying areas

Lot loans prepare the foundation for future build financing, while FHA, VA, and USDA loans extend affordability and reduced cash-out requirements to eligible Iowa homeowners.

How Do FHA, VA, and USDA Construction Loans Differ?

When evaluating government-backed options in Iowa, key distinctions influence eligibility and budget planning: exploring financing options

| Program | Down Payment Requirement | Eligibility Focus | Key Benefit |

|---|---|---|---|

| FHA Construction | 3.5% of total cost | Borrowers with credit scores ≥580 | Insured by HUD |

| VA Construction | 0% | Qualifying veterans and service members | No down payment required |

| USDA Construction | 0% | Rural property owners | Zero down for eligible rural builds |

Government-Backed Construction Loan Options and Down Payments

Government-backed construction loans in Iowa offer specialized options with reduced or eliminated down payment requirements. FHA construction loans typically require a minimum credit score of 580 and a 3.5% down payment. VA construction loans can offer zero down payment for eligible veterans, and USDA construction loans also provide 0% down payment options for qualifying rural properties.

This research verifies the down payment requirements and eligibility criteria for FHA, VA, and USDA construction loans, which are key financing options discussed in the article.

What Are the Eligibility Requirements for Construction Loans in Iowa?

What Credit Score Is Needed to Qualify for a Construction Loan in Iowa?

Lenders generally require a minimum credit score of 680 to 700 for standard construction loans, with higher scores improving interest rates and approval odds. Strong credit reflects responsible debt management and lowers underwriting risk.

How Much Down Payment Is Required for Iowa Construction Loans?

Down payments typically range from 20% to 30% of total project costs. Government-insured programs can reduce or eliminate down payment requirements, but conventional loans expect higher equity to mitigate lender exposure.

Iowa Construction Loan Eligibility Requirements

Lenders in Iowa generally require a minimum credit score of 680 for standard construction loans, with some seeking scores of 700 or higher for more favorable terms. Down payments typically range from 20% to 30% of the total project cost. Additionally, a debt-to-income ratio below 45% is often preferred to ensure borrowers can manage payments.

This research directly supports the article’s claims regarding the credit score, down payment, and debt-to-income ratio benchmarks expected by lenders for construction loans in Iowa.

What Debt-to-Income Ratio Do Iowa Lenders Prefer?

Iowa lenders prefer a debt-to-income (DTI) ratio below 45% to ensure borrowers can manage combined construction and permanent mortgage payments. Maintaining a conservative DTI ratio demonstrates sustainable repayment capacity.

Why Are Stable Income and Employment Verification Important?

Lenders verify steady income and employment history over the past two years to gauge repayment reliability. Consistent earnings from salaried positions or self-employment documentation strengthen your application and streamline underwriting.

What Construction Plans and Builder Qualifications Are Required?

Detailed architectural plans, engineered specifications, cost breakdowns, and a licensed builder agreement are mandatory. Lenders assess these documents to verify project feasibility, cost accuracy, and adherence to Iowa building codes.

How Does the Construction Loan Application Process Work in Iowa?

How Do You Choose the Right Construction Loan Lender in Iowa?

Evaluate local banks and credit unions based on:

- Experience with construction and one-time-close loans

- Competitive interest rates and fee structures

- Responsiveness and dedicated construction loan officers

A lender familiar with Iowa market nuances and building practices provides tailored guidance throughout your project.

What Are the Steps to Get Pre-Approved for a Construction Loan?

- Submit personal financial statements, credit report, and project overview.

- Provide preliminary construction plans, builder résumé, and cost estimates.

- Receive a conditional pre-approval letter outlining loan amount, interest rate, and required conditions.

Pre-approval confirms your borrowing capacity and strengthens your position when finalizing builder contracts and land purchases.

How Should You Submit Construction Plans and Builder Information?

Deliver full architectural drawings, engineered estimates, contractor licensing, and builder insurance certificates. Lenders review these documents to perform a detailed risk analysis and finalize loan terms.

What Is the Role of Property Appraisal in the Loan Process?

Lenders order a future-value appraisal—also called an “as-completed” appraisal—to estimate the home’s market value upon project completion. This ensures loan-to-value ratios align with underwriting limits and protects both borrower and lender.

How Are Loan Closings and Draws Managed During Construction?

Once documents are in order, you close the loan and establish a draw schedule tied to construction milestones. After each inspection confirms progress—foundation, framing, rough-in, finishes—the lender releases funds to cover subcontractor expenses and material costs.

What Happens When the Loan Converts to Permanent Financing?

For one-time close loans, conversion is automatic upon project completion inspection. If you used a construction-only loan, you undergo a second closing to secure a traditional mortgage. Either way, final underwriting confirms the home meets quality and value benchmarks.

What Are the Typical Costs and Financial Considerations for Iowa Construction Loans?

How Do Interest Rates and Rate Locks Affect Your Loan?

Construction loans often carry variable rates during build-out, converting to fixed rates at permanent closing. Locking in the permanent mortgage rate early can safeguard against market volatility, while construction-phase rate caps limit cost fluctuations. financing options for your basement

What Closing Costs Should You Expect for Construction Loans?

Closing costs include origination fees, title insurance, appraisal fees, and escrow charges. For two-close structures, expect costs twice—once for construction and again for permanent financing—while one-close loans consolidate fees into a single settlement.

Why Are Contingency Funds Important in Construction Financing?

Setting aside 5–10% of your budget for contingencies covers unforeseen expenses such as design changes, material price increases, or site delays. This reserve protects project timelines and prevents costly funding gaps.

How Does the Draw Schedule Work and What Are Inspection Requirements?

Draw schedules divide funds across key build phases, with inspections verifying work quality before each release. Common milestones include foundation completion, framing, mechanical rough-ins, and final finishes. Adhering to inspection protocols ensures compliance and timely funding.

Are There Tax Implications for Construction Loans in Iowa?

Interest paid during construction may be tax-deductible if the project results in a primary or secondary residence. Consult a tax professional for guidance on deductibility phases and IRS-imposed limits.

Which Local Iowa Lenders Offer the Best Construction Loan Options?

What Are the Benefits of Choosing Local Banks and Credit Unions?

Local lenders offer personalized service, faster turnaround times, and familiarity with Iowa building codes and county regulations. Community-based institutions often provide flexible underwriting for experienced homeowners and custom builders.

How Do Iowa Lenders Compare on Rates and Terms?

Rates and fee structures vary by institution size, loan volume, and geographic focus. Smaller credit unions may offer lower origination fees, while regional banks can provide promotional rate locks and bundle discounts for builder partnerships.

Which Lenders Support Owner-Builder Construction Loans?

Several Iowa credit unions and community banks recognize owner-builder qualifications and structure loans to accommodate self-managed projects. They often require detailed construction schedules and periodic site inspections to mitigate risk.

How Does The Busy Builders Collaborate with Iowa Lenders?

Our established relationships with local banks streamline documentation and builder verification. By presenting comprehensive project plans, verified budgets, and a licensed construction team, we help lenders fast-track approvals, draw releases, and future-value appraisals.

What Are Common Questions About Construction Loans in Iowa?

What Credit Score Is Needed for a Construction Loan in Iowa?

Most Iowa lenders require a minimum credit score of 680, with scores above 720 unlocking more favorable rate options and reduced fees.

How Much Down Payment Is Required for Iowa Construction Loans?

Conventional construction loans typically mandate 20–30% down payment, while FHA and USDA programs can lower or eliminate upfront cash requirements.

What Is a One-Time Close Construction Loan in Iowa?

A one-time close loan combines construction funding and permanent mortgage into a single transaction, minimizing closing costs and simplifying the financing process upon completion.

Can You Be Your Own General Contractor with a Construction Loan in Iowa?

Yes, Iowa borrowers can act as owner-builders if they demonstrate relevant construction experience, secure lender approval, and adhere to inspection requirements for each draw.

How Do Construction Loans Work During the Building Process?

Construction loans disburse funds in draws aligned with completed work phases. Borrowers pay interest-only on outstanding balances during construction, with conversion to principal and interest payments once the home is finished.

How Can The Busy Builders Help You Navigate Iowa Construction Loan Requirements?

How Does The Busy Builders Assist with Loan Documentation and Approval?

We compile detailed budgets, builder qualifications, project timelines, and compliance reports that lenders require. By packaging accurate plans, budgets, and scheduling data, we minimize underwriting delays and ensure draw inspections proceed on time.

What Are the Advantages of Working with an Experienced Iowa Builder?

Our deep knowledge of Iowa codes, local inspection protocols, and lender appraisal standards reduces risk, accelerates approvals, and delivers predictable project execution. You benefit from clear communication, reliable scheduling, and transparent cost controls.

Are There Case Studies of Successful Projects Financed with Construction Loans?

We’ve guided families in Ankeny, Urbandale, and rural communities through one-time close loans, owner-builder arrangements, and USDA builds. Detailed case studies highlight budget management, construction milestones, and smooth loan conversions that turned architectural visions into lasting homes.

Building your dream home in Iowa demands the right financing strategy, qualified builder, and coordinated lender partnership. With clear guidance on loan types, eligibility benchmarks, application steps, cost planning, and local lender selection, you can move confidently from plans to keys in hand. Partner with The Busy Builders to streamline approvals, maintain budget discipline, and complete your custom home with craftsmanship and financial clarity.

Frequently Asked Questions

What is the difference between a construction-only loan and a construction-to-permanent loan?

A construction-only loan provides short-term financing specifically for the construction phase, requiring a separate mortgage once the building is complete. In contrast, a construction-to-permanent loan combines both construction financing and the permanent mortgage into a single loan with one closing. This simplifies the process, reduces closing costs, and allows for a seamless transition to permanent financing once construction is finished.

What are the typical timelines for construction loan approval in Iowa?

The timeline for construction loan approval in Iowa can vary, but it generally takes between 30 to 60 days from the submission of your application to final approval. Factors influencing this timeline include the completeness of your documentation, the lender’s workload, and the complexity of your project. Being organized and responsive can help expedite the process significantly.

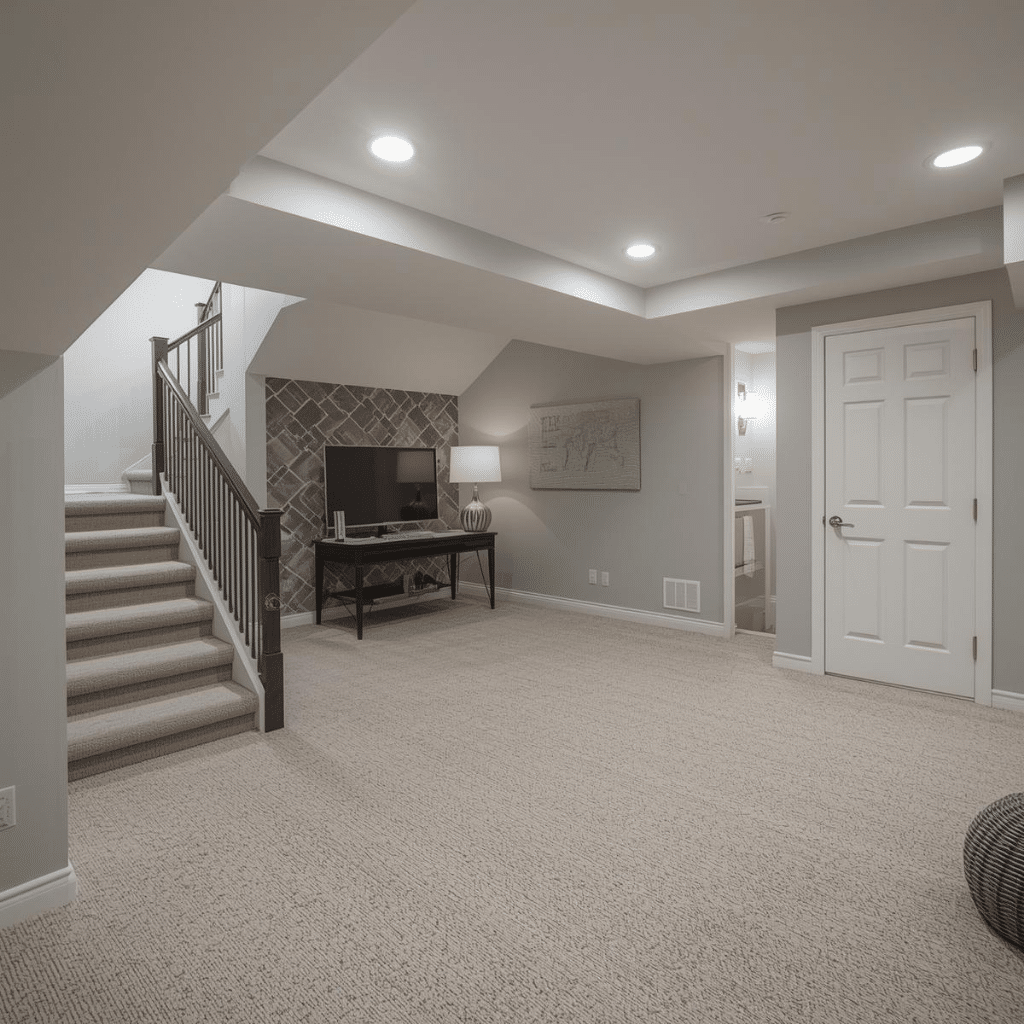

Can I use a construction loan to finance renovations on an existing home?

Yes, some construction loans can be used to finance renovations on an existing home, particularly if the renovations are extensive enough to require significant funding. Homeowners may consider a renovation loan or a construction-to-permanent loan that allows for both construction and permanent financing. It’s essential to discuss your specific project with lenders to find the best financing option.

What happens if construction costs exceed the original budget?

If construction costs exceed the original budget, it can lead to financial strain. It’s crucial to have contingency funds set aside, typically 5-10% of the total budget, to cover unexpected expenses. If costs exceed this reserve, you may need to secure additional financing or adjust project plans. Open communication with your builder and lender can help manage these situations effectively.

Are there specific insurance requirements for construction loans in Iowa?

Yes, lenders typically require borrowers to have builder’s risk insurance during the construction phase. This insurance protects against potential losses due to damage or theft of materials and the structure itself. Additionally, liability insurance may be required to cover any accidents that occur on the job site. It’s essential to discuss these requirements with your lender to ensure compliance.

How can I improve my chances of getting approved for a construction loan?

To improve your chances of getting approved for a construction loan, maintain a strong credit score, ideally above 700, and ensure your debt-to-income ratio is below 45%. Providing detailed construction plans, a solid budget, and proof of income can also strengthen your application. Working with an experienced builder and lender familiar with Iowa’s market can further enhance your approval odds.

What should I do if my construction loan application is denied?

If your construction loan application is denied, first, request feedback from the lender to understand the reasons for the denial. Common issues include low credit scores, high debt-to-income ratios, or insufficient documentation. Addressing these concerns—such as improving your credit score or providing additional financial information—can help you reapply successfully. Consider consulting with a financial advisor for tailored strategies to enhance your application.